Performance of an IRA Fund Guided by VIXEK™

The science (and art) behind VIXEK™ has been used in managing an IRA (long-only, no margin) equity investment portfolio.

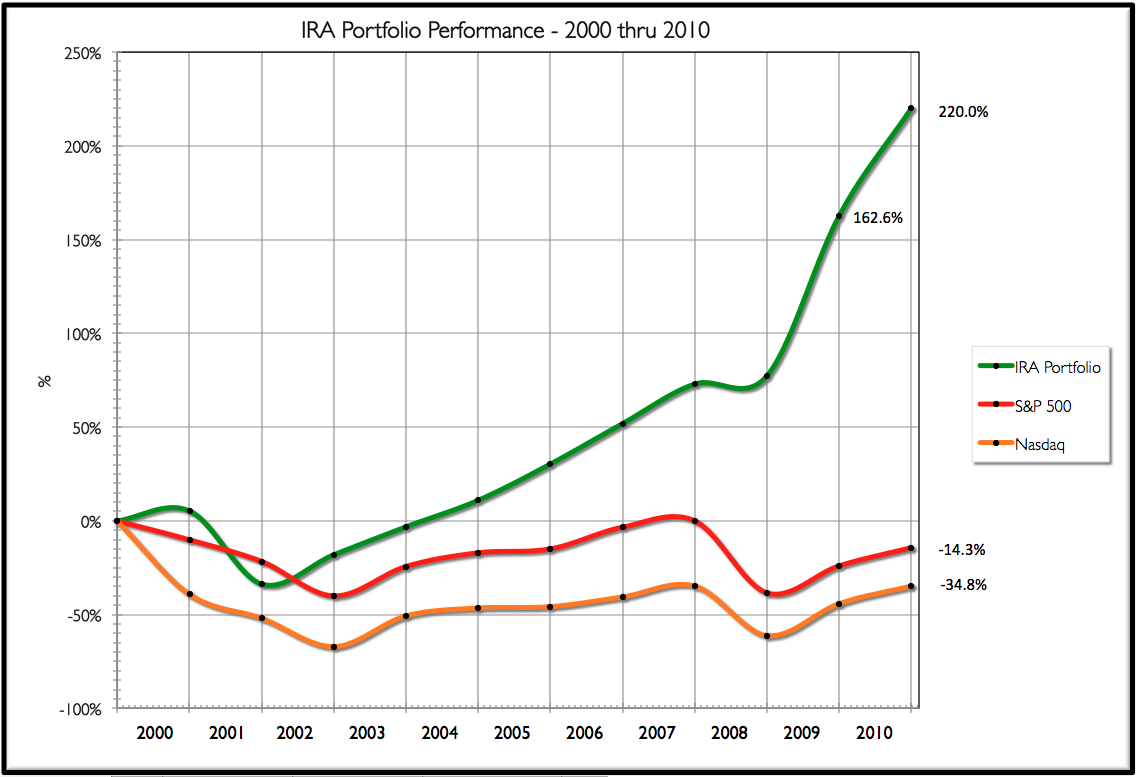

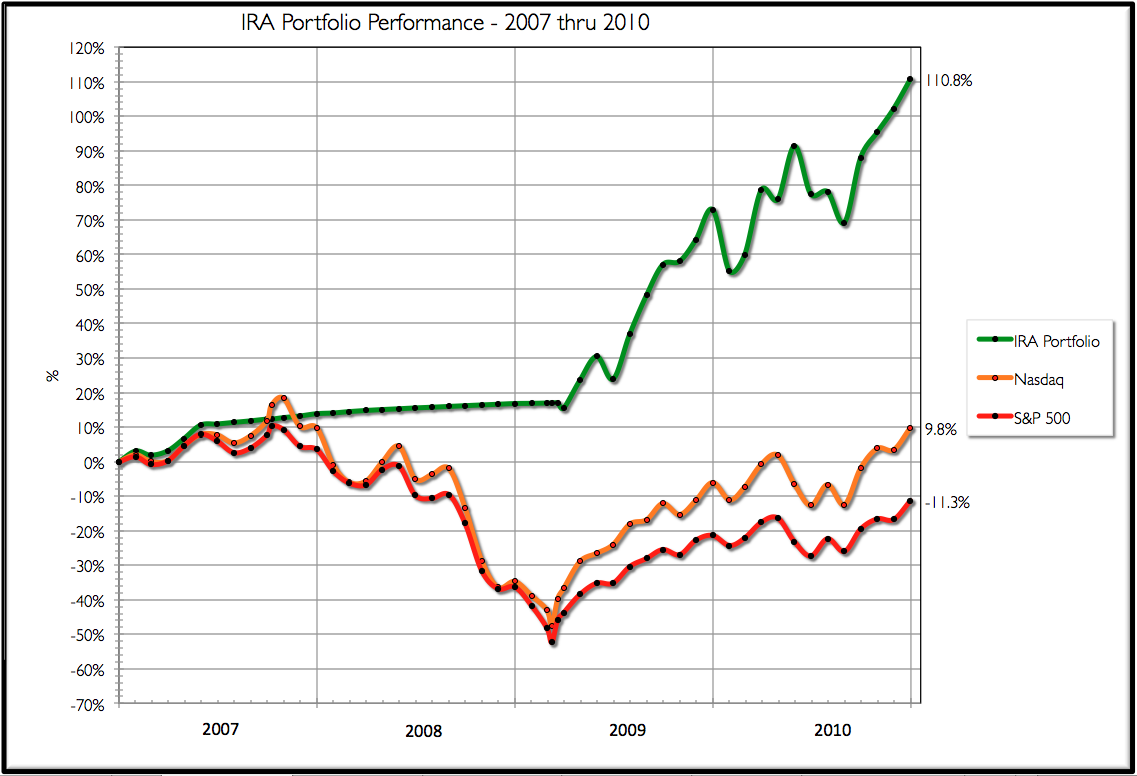

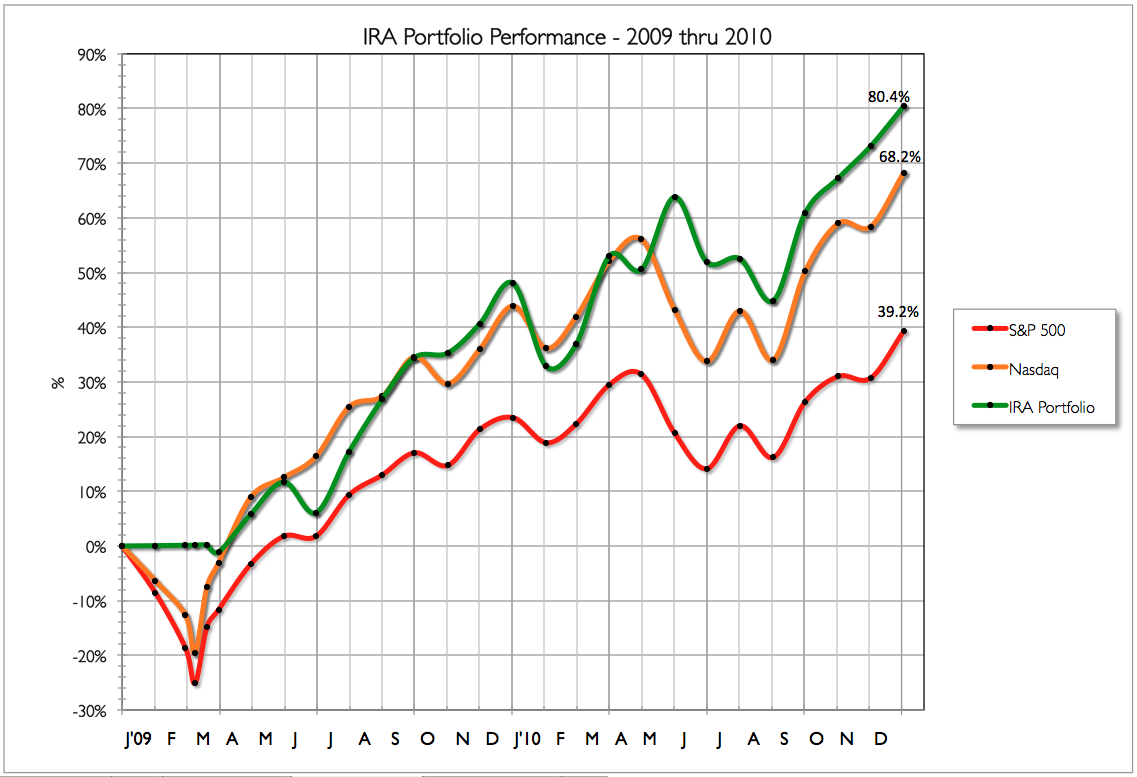

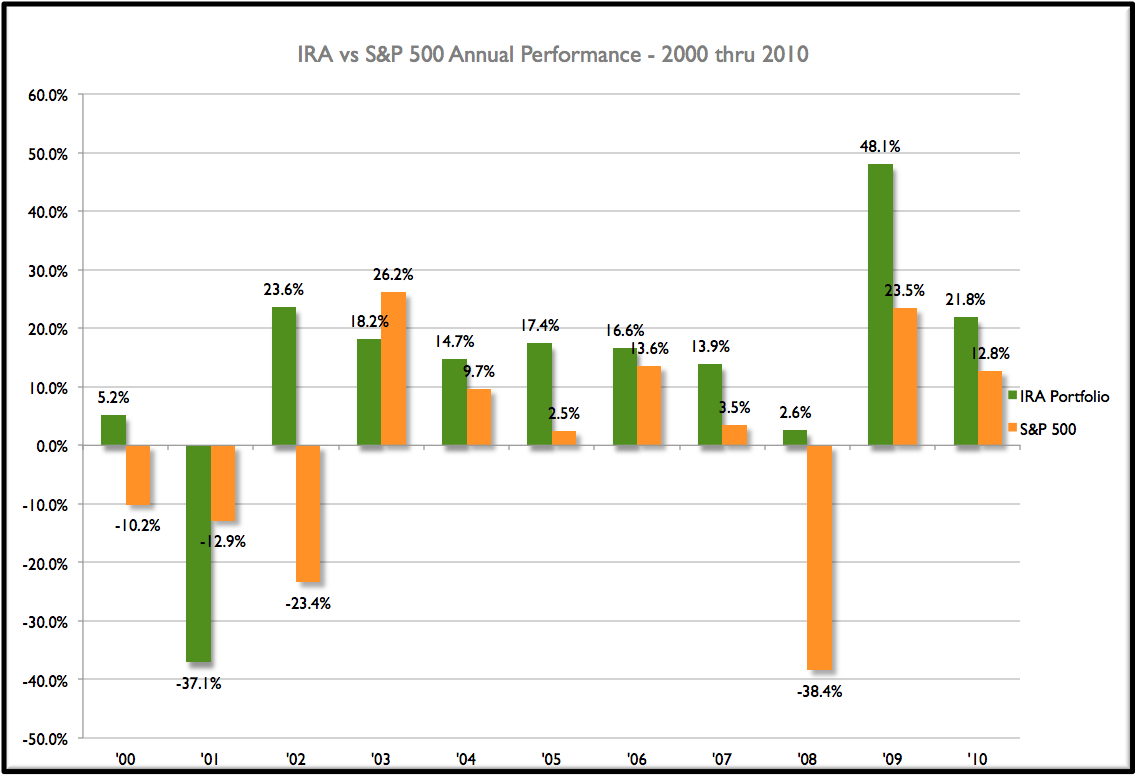

Its performance - including all transaction costs, commissions and some dumb, money-losing trades - has been spectacular.

The key benefit of VIXEK™ is in knowing - with a reasonable degree of confidence - when to be invested in the market and when to go into cash.

According to Morningstar, there are over 4100 mutual funds investing in US-traded equities. This VIXEK™ guided, actively managed portfolio's 1-year and 10-year performance was better than 99.6% of these funds. And it was better than ALL of these funds on a 3-year performance!

As of December 31, 2010, this portfolio performed better than S&P 500 in nine out of the past eleven years. It lost value only once (in 2001; S&P 500 lost value in 4 out of those 11 years) and its performance lagged S&P 500 only twice (in 2001 & 2003).